Top 5 Investing Mistakes to Avoid as a Stock Market Beginner

I have personally made many mistakes while investing money in the stock market. I tried to “time the market” which went fantastically wrong. And made investing decisions purely based on someone else’s recommendation. Funnily enough, I made all these investing mistakes while working in the investment industry myself.

The truth is: even the most experienced investors and fund managers are not guilt-free when it comes to losing money in the stock market. Some simply do not admit to it. When I first started working in the investment industry, I was really surprised to find experienced fund managers also making some of these investing mistakes. It made me realise that they are also human. At the end of the day humans are bound to make mistakes. Especially now that we are going through a rather rare moment in our life (the pandemic, US election & BREXIT) all at the same time; it would be a decent task to cut through these noises and touch-base with our investing habits. We should really be focussing on ourselves and the things that we have control over in order to make better investing decision.

Here are 5 common investing mistakes people make in the stock market, along with ways to prevent them.

Unrealistic expectation

Do you not feel that expectations are just massive burdens that only gives all sort of unnecessary agitations? Whether it comes from parents thinking that their kids will ace at an exam or a partner thinking that their other half will never ever forget to wish them on that very special day that they first met. Expectations are uninspiring. I absolutely don’t like it when I am made aware of people’s high expectations of me. So – why do it on myself?

In other words, please don’t be so hard on yourself or your investing luck to think that the stock market will make you rich overnight. It is very unlikely that you will double your money in a few months and generate a great source of passive income to quit your job the next day. Stock market is not a “get rich quick” scheme. It is a great, legit method of allocating our capital so that it can grow better. It is definitely a smart idea to have money invested in the stock market than leaving them in a zero-interest savings account where it loses its purchasing power.

The reason why Unrealistic Expectation is a mistake is simply because you are overpromising yourself and already discounting all the potential risks that comes with investing in the stock market. In stock market investing, there are no guaranteed returns. And so, when the table turns and things don’t go to plan, you will be disappointed. Therefore, you should not put yourself in a position where you lose hope and ultimately give up investing!

Watch the Video Version!

Copying someone else’s homework

On this point, I must come clean. I am guilty of committing this mistake. Since my job involves working with Fund Managers on a day to day basis, I naturally pick up on many stock recommendations and ideas. Couple of years ago, when I first started working in the industry, I learnt about a great dividend paying stock which all the value fund managers were claiming to be very cheap. I studied the stock very briefly and thought it would also be a good buy for my portfolio. That was a mistake. Although there was nothing wrong with the stock itself, it behaved as expected, i.e. paid out consistent amount of dividends. However, it was a mistake because that stock did not suit my own investment style. Given by long expected investment horizon, I personally invest for high growth in my capital and don’t necessarily need dividend income. I have learnt from this mistake the hard way.

On this point, I should add that there is a common characteristic with stocks that people generally buy through word of mouth. That characteristic is called “momentum”. A momentum stock is one where the price of the stock has risen increasing over last few months. These stocks happen to be very hyped. The danger, however, with these stocks is that they are more likely to turn into a “stock bubble” and “pop” at some point. A stock or an asset bubble is when the price of the stock bares no resemblance to the underlying value of the company. When these stocks do “pop”, they tend to lose a significant value of their price. Therefore, while investing, we need to realise that it is not just “money” that we have to invest, we also have to invest “time” doing our own research.

Speculating

We speculate when we try to time the market and buy the dip. It goes hand in hand with day trading. Day traders aim to buy and sell stocks throughout the day hoping to make a profit. However, statistics around day trading is dire. 80% of day traders loses money over one year. Their median loss is circa 36%. If you take 8% as an average stock market return, it means day traders underperform the market by -44%. This is a huge blow.

Investing in speculative stocks could be a mistake because as a new investor, it will require a lot of time & effort from your side to study their thesis. And the statistics around day trading don’t look great either. If you observe some of the most successful investors, like Warren Buffet, you will notice that they always aim to invest for the long term and do not take part in speculation.

There is a MUST-read book on investing: (which potentially everyone in investing has read) The Intelligent Investor by Benjamin Graham. Warren Buffet called this book “By far the best book on investing ever written”. This book really helps breakdown the need to invest and not speculate.

Speculative Stock Example

At this current climate I can think two types of stock that serves more on speculation than investing. One would be some of the airline stocks. We are aware of the impact of 2020 pandemic on the travel industry. Stocks on this sector saw their value drop by as much as 80%. Seeing a company price drop so much could be tempting to think of as a buying opportunity. However, there is a greater chance that these stocks could be viewed as trying to catch a falling knife. Whether an airline company survives depends on their balance sheet. Many of these airline companies have huge fixed cost and a high level of debt that they are legally required to pay on time – to prevent bankruptcy. As a result, initiating positions in these companies (without extensive research) are very risky and speculative. Another great example would be microcap biotech stocks. Investing in these stocks give a binary outcome. How the stock performs depends on whether the company passes their scientific trial, which no one really knows at the onset.

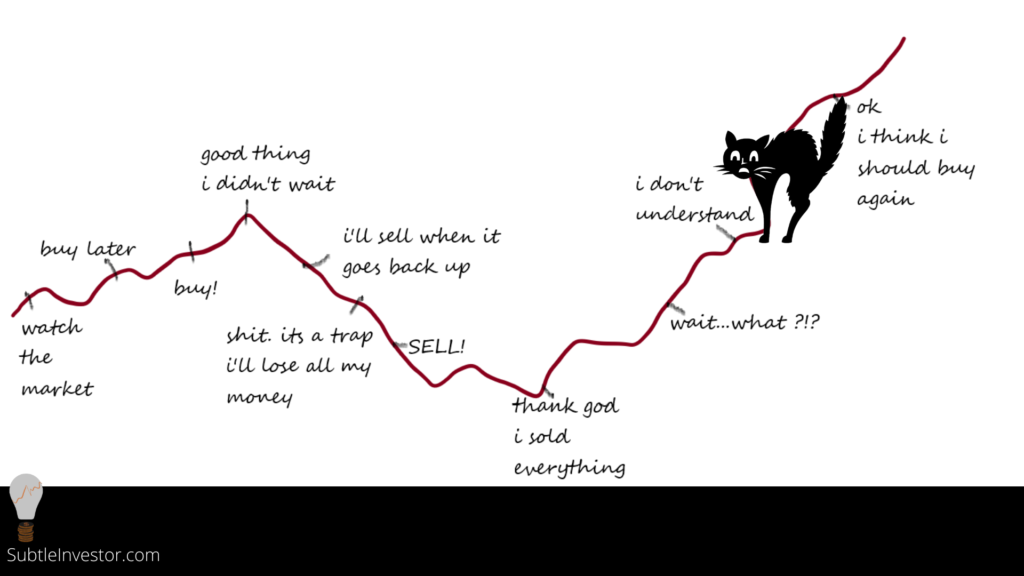

Emotions and lack of patience

I feel we need to have a deep think about how we allow our emotions to impact our investing behaviour. Buying and selling shares have become ever so easy these days, thanks to many platforms like Trading 212*. As a result it has also become easy to turn our emotions into an action with a click of a button. In decision making, humans are bestowed with countless behavioural biases (all tucked away in our subconscious). One such example is “loss aversion bias”. In simple terms, it mean we hate to lose money. However, study on this bias is very revealing. Prospect theory was able to quantify that humans feel twice as much pain from losing the same amount compared to winning. As such, to avoid any pain of losing we are prone to behave in irrational ways. A good example would be how we react to news during market crashes and rallies. The picture below highlights this.

Lack of discipline

Unlike nice, neat financial theories, the market is not actually made up of rational investors. And because of all our irrationality and herd like behaviour, behavioural finance has made modern portfolio theory pretty redundant. Discipline investing can help tackle many of these irrational behaviours, like loss aversion.

So, how might discipline look like? There are a lot of ways we can introduce discipline in our investment portfolio, such as:

- Constructing a well-diversified portfolio, i.e. not letting any single stock make more than 10% of the portfolio

- Following our own price target. This will prevent us from buying or selling a stock until it reaches the price we think is logical

- Having a capital allocation strategy. For example, we may wish to set up a monthly direct debit in our investment account rather than holding onto cash, waiting for the market to dip

- Preventing reactive buy/sell decision driven by rumours in the market, such as: BREXIT wouldn’t happen or market will crash next month

I learnt a great deal about my own psychology and thought process by reading Thinking Fast & Slow, by Daniel Kahneman. The book really nails down our thinking process and highlights how we can make better decision.

The summary

The bottom line is this: mistakes will be made. We should not be intimidated by it. The best we can do to help avoid these mistakes are:

- Setting a realistic expectation

- Doing our own homework before buying and selling

- Finding a discipline investing strategy that works for us, and sticking to it

- Avoiding speculation and emotional trading

- And just enjoying the process of learning and investing. Because, as long as we are growing as an investor, our portfolio would also grow! 🙂

*The link to opening an account with Trading 212 includes my referral code. If you open an account with them we will both get a free share worth up to £100

Other links in my post may also include affiliate links from Amazon. I may earn a small commission (at no extra cost to you) if you purchase a product using these links.