UK Recession and our Money

We all saw the headlines. Last Thursday afternoon (4th August) I was busy finalising couple of my usual monthly research notes at work. To name a few, I was covering topics on the US-China tension around Taiwan and the IMF’s (International Monetary Fund) outlook for UK and Europe. Before sending out the pack, I was simply looking to update a sentence on the macro data with the new interest rate hike from the Bank of England. Put it simply, I was gobsmacked. The Bank dropped a bombshell. I don’t think anyone was quite ready to read about the full-blown narration of the upcoming recession that is kicking off at the end of the year. So, my late Thursday afternoon was spent, frantically putting additional notes on that front!

Read on as I summarise the key findings on our economy, why UK is expected to look worse compared to other countries and what it means for our money.

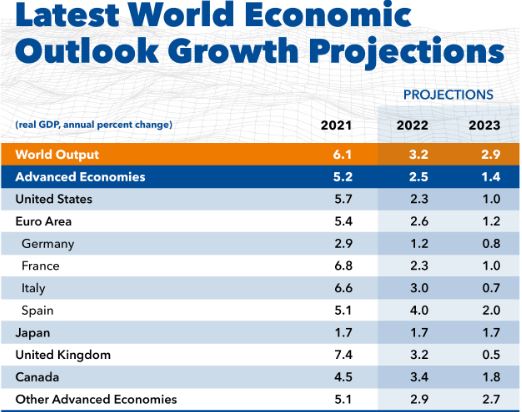

The IMF downgrades UK to the bottom of the pack

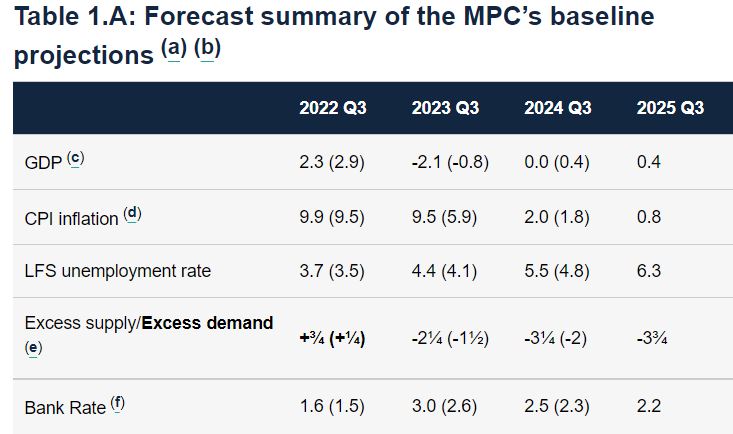

A week ago, the forecast for UK, similar to most parts of the world were downgraded by the IMF. UK is projected to underperform the rest of G7 countries next year. The 2023 growth number for UK is +0.50% vs 1.4% for “advanced economies”. Generally company revenue and profitability goes hand in hand with GDP growth – so this is not a great outlook for UK stocks.

...and the Bank of England adds salt to the wound

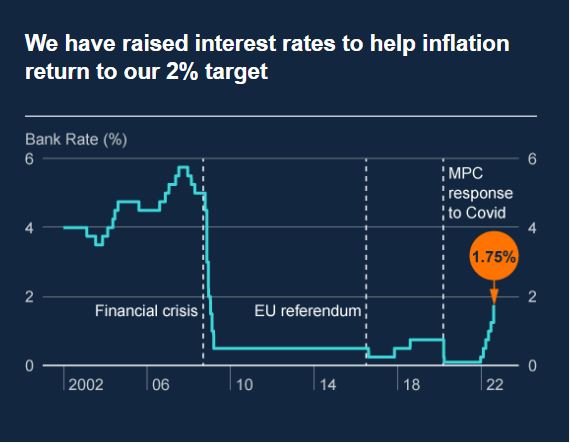

Closer to home, the Bank of England who independently sets interest rates for the UK, also downgraded growth expectations. The Bank recently increased interest rates by 50bps by a majority of 8-1, to 1.75%. This marks the biggest single rise since 1995. With inflation running hot at 9.4% (as of June) the Bank’s hands are tied.

...the disastrous energy shock

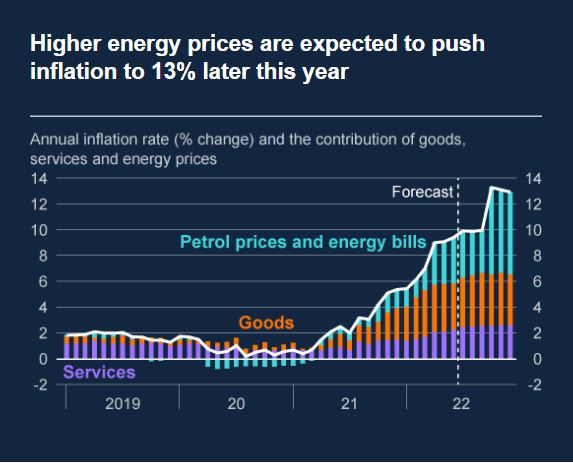

The war in Ukraine initially led to increase in energy prices. Some of those wholesale price increases have started to feed into consumer prices.

In April, we already had 54% increase in the energy price cap. And according to latest projections by Cornwall Insights, they may increase again by 70% in October. In monetary terms, this reflects an annual energy bill of around £3,450. Personally, last April’s increase scared me and I cannot even begin to imagine what the next increase would do to household finances. The Bank estimates that if Ofgem’s price increase materialise, it will take our inflation level to 13%!

Think about that – that’s the percentage increase in our cost of living in just a year. This is hugely different to the average 2% increase that we are all used to. We are living through a financial crisis. I hope the next government is loud and clear about that.

its a full blown crisis...

In terms of economic impact, we are expected to have negative quarter growth from the final quarter of 2022. And then the following 4 quarters are also expected to show contraction in GDP. In annual growth terms, the largest drop is expected in Q3 2023, where GDP could decline by 2.1%. So, this is not a short-lived recession like the pandemic. It will be a yearlong recession where people don’t spend much, businesses don’t invest or hire much yet inflation remains very high.

Why UK set to suffer most

To summarise, the key reasons behind this gloomy outlook, especially for the UK is as follows:

- Global supply chain issues are still keeping prices high for businesses, which are being passed on to consumers. If geopolitical relationship deteriorates with China (related to the sovereignty of Taiwan), it can get worse from now

- War in Ukraine shocked the price of energy and food, which increased our cost of living. The timing of Ofgem’s price cap calculation means consumers are now facing eyewatering increase in bills, another 70% just as the winter arrives. The already announced help from the government is not enough to offset the jump

- Although wages have been increasing, they have significantly lagged the increase in prices. So, in “real terms” wages have been falling. This translates to a real squeeze in household income

- Brexit uncertainty still dominates, especially around Norther Ireland protocol. Hopefully, some clarity will come as we seek to have a new prime minister. Overall, the impact of Brexit has broadly been inflationary because it led to reduction is labour supply, weakening of pounds and increasing trade barriers with Europe

What does it mean for your money?

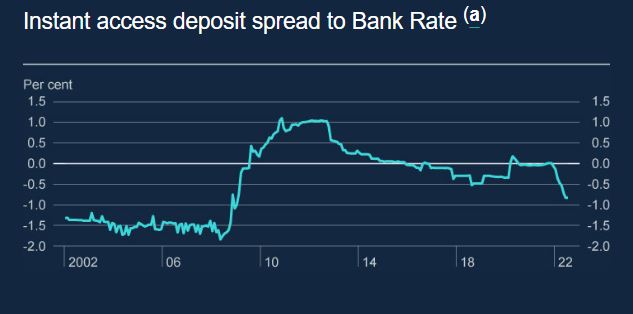

In theory higher interest rates are expected to help savers. In other words, we are expected to save money in interest bearing savings account rather than spend. However, it appears that the banks have been reluctant to fully pass those onto savers but have been very quick to increase cost for the borrowers. So be mindful of where you save your money and with whom. Shop around for high yielding savings account.

But, how high can rates go?

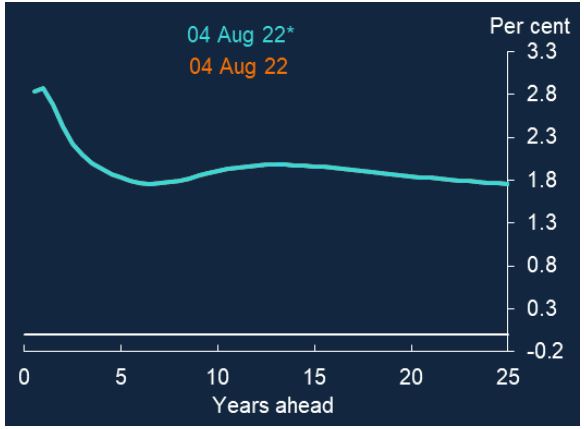

Now you might be thinking, what if rates rise by even more- is it a good time to lock away money? You’re right to think that way. Since we still don’t know how much further the rates will increase by, it would probably make sense to keep them in easy access savings account. In our finance world, we look at things like the forward curve – which gives the market’s view on where they think short term rates (i.e. those close to base interest rates) are headed.

And currently, it appears that rates are likely to peak around 3% (currently Bank Rate is 1.75%) – so it probably makes sense to observe how market perception changes too.

Is the stock market any good?

In terms of the stock market, some of the bad news would have started to be reflected already in the prices. But there are always risk that the market may fall further. It’s again worth remembering that not all countries will on the same business cycle; some will lead the others. For example, China is yet to start increasing rates, instead it is actually still cutting them. Therefore, a good level of diversification by geography is very important.

Same goes with the types of assets too. It may be a good time to think about getting some exposure to bonds that are still offering real income (i.e. yields higher than inflation). Other than those, this year I have personally been holding onto cash in savings account than investing into the stock market. That being said, one of the best times to buy is when the real economy hits the bottom since stock market generally leads the business cycle.

On that note, I am holding onto my cash savings real close and making sure there is enough money in the emergency pot for both myself and my family.

The summary

Things are looking tough. I personally feel, the BIG Shout by the Bank of England will help push for more support from the government and help us become more financially alert – which in turn may help the recession become actually less painful than forecasted.

All in all, I hope we are all able to weather this storm with as little damage as possible.

Yours Truly, Subtle Investor