Why high inflation won't last for too long

High inflation remains one of the most cited concerns for policymakers and consumers like me and you. With large inflation prints coming out month after month, there’s no surprise that it is making everyone a little uneasy.

But I am here to explain why inflation figures are likely come down around mid next year and remain low over the long-term.

This is not just my personal view, but the view shared by all the heads of central banks in the UK, Europe, and US, plus the IMF.

Let’s start from the basics.

What is inflation?

Inflation is a measure of general rise in prices of goods and services in an economy. The inflation we mainly talk about is called Consumer Price Inflation, or price changes faced by consumers. It is measured by taking percentage change from the Consumer Price Index (CPI).

The CPI measures price of a basket of goods. Think of this basket as your shopping trolley, assuming you buy the same items every month, the change in total price you have to pay at the checkout every month is your monthly price increase or monthly inflation. Even though it is a monthly index, inflation number is typically quoted on an annual basis.

So, if in May last year you paid £100 for your monthly shopping, but in May this year you paid £105, it means inflation in May 2021 is 5%.

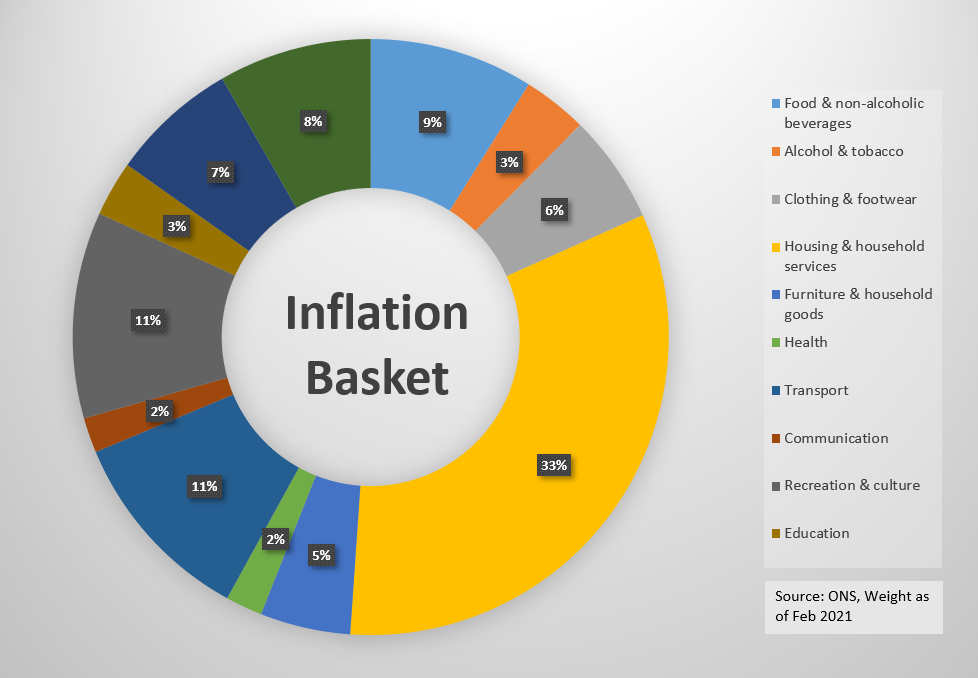

What makes up inflation?

Here is what makes up an inflation basket. As you can see a large chunk is made up of housing & household services which includes rent, utility bills, council tax, house appliances and so.

What is the current level of inflation?

At the time of writing, annual inflation in the UK is 3.2%, in the US it is 5.3% and in Europe it is 3%.

Why central banks care about inflation?

Because it is their primary job! Central banks are independent from politics and are responsible for keeping price rises low and stable. Most of the advanced economies such as UK, Europe and US set this target at 2% every year. It is important that we have stable inflation in our country because “If inflation is too high or it moves around a lot, it’s hard for businesses to set the right prices and for people to plan their spending”.

This doesn’t mean we want it to be too low, like 0% or even negative. Because when inflation falls and gets close to zero it signals to us those prices are likely to fall more in the future and so we delay buying stuff. This can have multiple ripple effect for business profitability, economic growth and also our jobs!

Why is the high inflation expected to be temporary?

Base effects: This this a technical reason behind why inflation is less likely to remain high going forward. As I mentioned earlier, inflation is a percentage change between two numbers. Due to COVID, last year we had a detrimental impact on prices of goods and services in our country because businesses had to shut down. This means last year’s price index was low. However, this year as the economy started to reopen, everyone was able to spend money, increasing the value of the index for this year. As a result, percentage change is higher.

Technically, this should not happen in a year or two years’ time because current prices are already pretty normal or even elevated, and so unless we have another price shock, inflation should not be so high in the future.

Release of pent-up demand: As the economy started to open up again, with people vising restaurants, flying internationally and companies starting factory production – there’s been an explosion of pent-up demand in the world. For example, as Asian production heavy countries reopens, they are suddenly in need of a lot of energy which is putting upward pressure on oil and gas prices. These commodities are also an input cost for consumers since we also have to pay for gas & electricity bills.

Easy monetary and fiscal support: This is pretty much referring to the fact that during the 2020 pandemic, both governments and the independent central banks have been supporting and stimulating the economy. US governments handed out free money which more than compensated for lost incomes for their citizens, while in the UK we had a furlough scheme where the government paid for people’s wages. On the monetary side, central banks cut interest rates to make it cheaper for people to borrow money and pay down on any loans. This easy economic policy definitely helped people to also spend more.

Sectoral impact & supply side disruptions: Again, due to COVID companies are facing a lot of disruptions in getting raw materials they need to build their products. This is because COVID infections are shutting down factories and shipping ports in places like China. This means, manufacturers are having to pay higher cost for the same products they used to get a year ago. This is expected to ease overtime (although no one knows when). When the disruptions are gone, lower inflation readings should also follow.

Why long-term inflation will be lower and contained?

Independent central banks: a key reason why inflation has been relatively stable and low over the last 20 years is because central banks have been doing a good job at keeping it low. This is their main mandate. And so as long as they carry on doing this work, anchoring our expectations of future inflation, over the long-term inflation should remain low and stable. A key risk to inflation staying higher is our own expectations! If all of us starts to believe that inflation will be higher, then by our own prophecy, it will permanently become higher! For example, if you think prices of washing machines will be 10% more in a year’s time, and you really need one, wouldn’t you prioritise buying it today?

Globalisation: globalisation “is the process by which businesses or other organizations develop international influence or start operating on an international scale.” Think about items you buy which says “made in China” or the call centre representatives you speak to who are based in India – these are all results of globalisation. And although globalisation of goods may slow as countries want to become self-sufficient, globalisation of services is likely to continue. One simple reason is because of ‘labour’. In developed world, especially in parts of continental Europe working age population is in decline, therefore there will be an increasing need to outsource their work to other countries.

When companies can make good for cheaper or import goods in a cheap way, it automatically keeps price rises lower.

Automation: Advancement of technology will only increase further. This means you can produce more output, quicker and hopefully cheaply which should reduce prices. It also allows you to better compare prices online, reducing pricing powers of firms.

Demographics: Over the last few months, impact of demographics has been widely discussed as one of the factors for keeping inflation low. One of the routes to understand impact of demographics on inflation is by the wealth channel. We have income and wealth inequality problem in our country (really harsh for the US too!). And the fact about rich folks is that they have so much money that they don’t really have places to ‘spend’ them as much as we do. I mean how many cups of Starbucks can you realistically have every day?

What this means is that rich people save more and have low propensity to consumer or spend. This is complete opposite to not-so rich people. Money struggling people hardly have any money left to save and invest, so whatever income they make, they tend to spend it all on necessities. So poorer people have high propensity to consume.

And so, as long as we have this situation, rich people’s money just wont show up in prices, hence keeping inflation low.

What does all of these mean for us, our investment, and ways of life?

Well, that is a whole other topic, for that may I point you to my YouTube video below? 😉

Final thoughts...

Overall, I think as long as we stay humane, conscious, and calm (& not panic buy, tut tut if you’re one of them) we should at least not make things worse for ourselves and can happily pass on the blame around to the government.