Investing in Stock Market | 3 Reasons why 2020 is a great opportunity for beginners

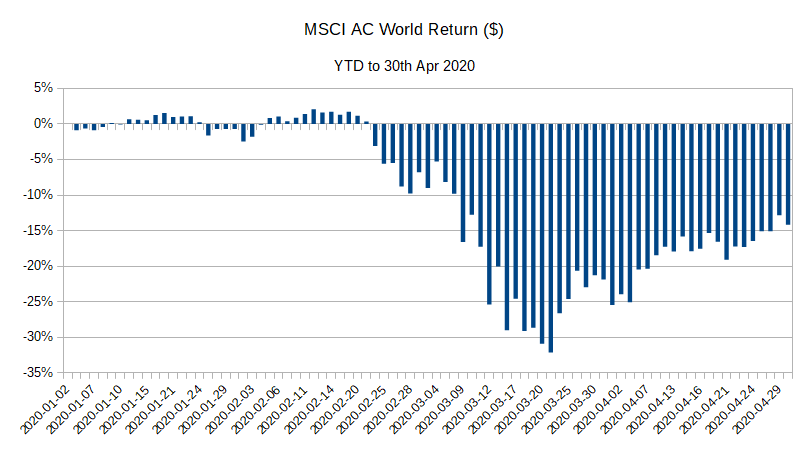

The best time to start investing in the stock market was 20 years ago; the second best is now! The truth is that regardless of any investment styles, ultimate goal of every investor is the same – and that is to “buy low, sell high”. Sounds pretty obvious, but you’d be surprised at how difficult it is to execute. Just look at the chart above of stock market returns year to date (represented by MSCI AC World). Pretty scary to be honest, no thanks to COVID-19.

But, as the saying goes, every cloud has a silver lining. And while this dire pandemic is busy creating panic in the financial market – it is also opening up a vacuum for long term investors. Sensible investors don’t panic, they maintain caution.

1. It’s very cheap to invest in stock market right now

2020 is likely to remain bumpy. Panic leads to rush sells. Law of supply and demand tells us that a drop in demand leads to a fall in price. That is exactly what’s happening right now. The market is pricing in this uncertainty over the short-medium term which is opening up attarctive entry point for investing in stock market. Even best for new investors. In stock market investing, we observe relative “cheapness” by various ratios such as “price-to-earnings” – lower the number, cheaper it is. Observe the chart of FTSE All Share below (proxy for UK stock market), compared to 10 years history is looking very attarctive. Potentially undervalued right now. A similar story is seen across many other stock markets and companies.

If there is a company or a market that you’ve been procastinating to invest in – it might be good time to slowly start buying in. Yes, it’s prudent to say that it may become even cheaper in the future but that’s just something no one knows. Over the coming months it is important to move with caution and slowly start to invest. Thanks to the concept of “Dollar Cost Averaging” – you are more likely to have better returns than those who tried to “time the market”.

2. Time in the market > Timing the market

While investing in stock market, no successful investors (the likes of Warren Buffet) found their glory while trying to “time the market”. In other words, trying to buy when the price had hit rock bottom – because guess what – again, no one really knows. A true investor reaps the reward through patience and steadiness. Driven by the power of compounding, over the coming years a steady flow of investment will only grow as the market turns to recovery. I have another post on “Two important concepts to master as a successful investor” where I discuss “Dollar Cost Averaging” and “Power of Compounding”. Once you really understand these, your mind will be blown, I promise.

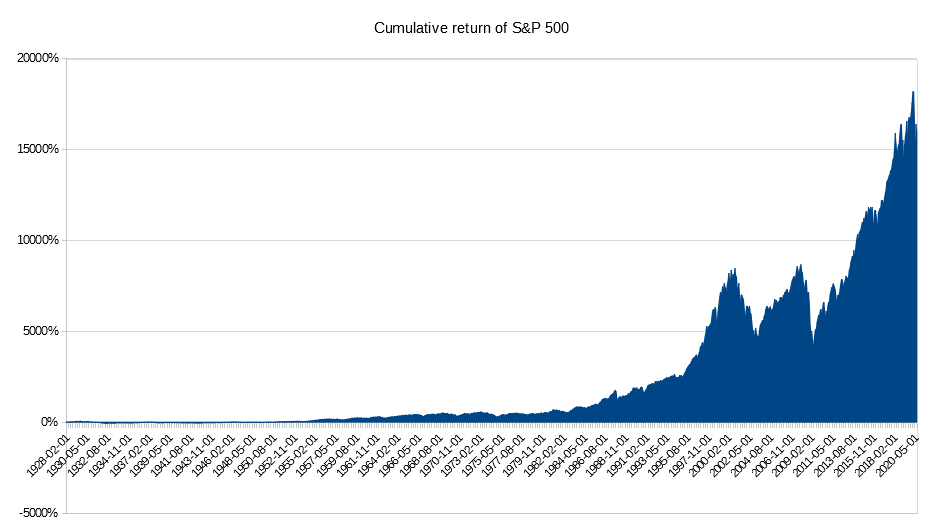

The below shows cumulative return on S&P 500 (proxy for US stock market return). You’ll see that over the decades there’s been many incidence of stock market crash. However what remains also true is that over long run stocks tend to go up. From any starting point since 1926, U.S. stocks as represented by the S&P 500 have always generated a positive 15 year return.

3. Saving accounts are losing real value of your money: recall inflation?

Cash is king they said. But I ask “for how long” ?

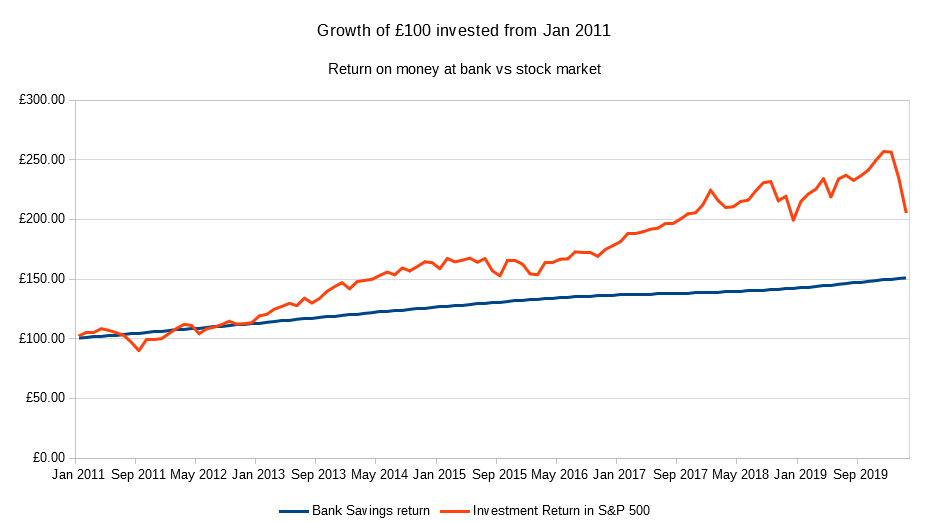

Look at chart above of how much £100 would have grown. Blue line shows growth if you had left it in a regular UK savings account over 9+ years. Red line shows if you you were investing in stock market. Even with the recent market sell-off, the investment would’ve doubled compared to leaving it in bank account.

Now lets think about the future: we may remain in a world of low interest rates for longer! Governments around the world is using interest rates as tools to tackle this pandemic (monetary stimulas). Following them, many banks have been very quick to reflect this in their consumer savings account. Big banks like Halifax, RBS and HSBC have already announced savings rate cut. Many already giving a rate of merely 0.1%. What does this mean for your investment? It means you will earn next to nothing. Infact leaving your money idle in the bank account means you are losing actual value of money. Here is a really useful equation to understand (Fisher Equation).

Fisher Equation

Nominal Interest Rate = Real Interest Rate + Inflation

…at the time of writing, May 2020, a popular international Bank is offering 0.01% AER (Annual Equivalent Rate) if you keep your money at their savings account.

Let’s plug that value in our nominal interest rate, and lets use March 2020 UK inflation rate of 1.5% as a proxy for future expected rate of inflation. This gives us real rate of interest or real rate of return of negative 1.49% !!

Real rate of return = 0.01% -1.5%

In practical words, this is reducing your purchasing power as a consumer.

Why this happens? Say a watch currently costs £100 and you have £100 in your pocket which you can use to easily pay for the watch. But, you decide to save that money in your bank account. A year from now your £100 savings in bank would give you back £100.01 to spend on a watch which would now be costing £101.5 – and guess what? you can no longer afford it. Inflation ate away the value of your savings, your purchasing power diminished – you made a negative real return. This is why its important to remain invested in the stock market.

The summary

- Stock market tend to go up over time and it is currently looking “cheap” to buy

- Over the long term, investment in stock market is likely to outperform the near non-existent rate of return from cash at your bank

- Therefore, it is smart to subtly start investing bit of your money rather than holding onto them in cash (& losing its value)

...but before you start to invest in the stock market, please remember:

- If you don’t have enough money to meet short term financial obligation, save some before starting to invest (rule of thumb to always keep 3-6 months of salary in accounts you can easily withdraw from)

- Set up monthly investments rather than investing all your money at once

- Don’t put all your eggs in one basket – start with investing in a diversified fund or an ETF rather than putting all your money in a single stock/share