Compound Interest and Dollar Cost Average - master the concept as a successful investor

What is compound interest?

There’s an old saying that “money doesn’t grow on trees” – but what if you realise that it does grow, but on interest?

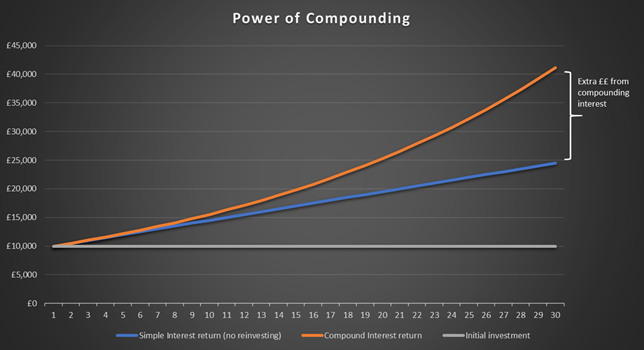

Compound interest means the original amount you have invested will end up growing for you, exponentially, without you having to actively do much.

How? By getting “interest on interest”, in other words, reinvesting your earnings (interest / dividends) back into the investment and not simply cashing it out.

“..My life has been a product of Compound Interest” – Warren Buffett (click to read his profile)

Example of how: Let’s put this into perspective using a hypothetical investment that pays an annual interest of 5%

Year 0: You make an one-off investment of £10,000

Year 1: total investment value is:

Your original investment and the 5% interest return over 1 year = £10,000 x (1+5%) = £10,500

Now, if you don’t cash out on the interest payment (£500) and leave it in to be reinvested back, you now have that additional money which will passively work for you…

Year 2: Total investment value is:

Total investment value from last year plus interest received over year 2 = £10,500 * (1+5%) = £11,025

Fast forward to year 10…guess how much that subtle 5% interest returned you? £16,289! A return of 63% without you having to even do anything…and that is compound interest!

Have a go at Compound Interest Calculator below

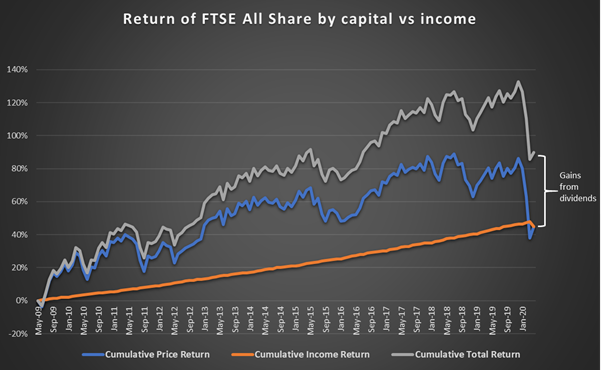

Example: Compounding effect in equity investing

Let’s put this into a practical concept on equity investing. The great thing about investing in an equity fund is that, you not only get a return from any increase in price of your unit holding or share (called capital return); you also get an income return on top of that (dividend return) – which we can reinvest back just like interest income in compound interest example above. This is where the concept of “Total Return” comes in:

Total return = Price return + Dividend return

Let’s look at historical return of FTSE ALL Share and break it down by price and dividend return .

From May 2009 to April 2020 – a cumulative total return chart shows us just how important reinvested dividends have been given the recent market sell off. Cumulatively, both price and income equally accounted for total return over this investment horizon. Thinking differently, if you had not been reinvesting dividends back into the market (and simply took it out) – you’d have nearly 50% less in your current investment pot (note: generally price of a stock falls by an equal amount following a dividend paid)

Two: Dollar Cost Averaging

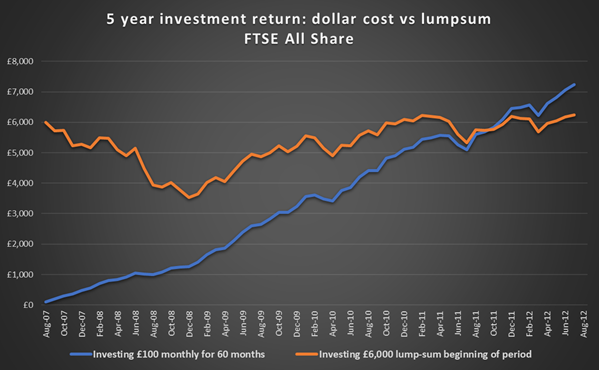

Best times to buy is when the prices are low. But, Realisation of ‘low prices’ generally comes in hindsight as timing the market is extremely difficult. In order to take this pain away, investors can employ a basic strategy called dollar cost averaging.

What is Dollar Cost Averaging?

The idea is to invest a fixed amount at a consistent interval over a long period of time (regardless of high/low prices), rather than trying to pick a certain date to invest it all at once.

This strategy can work because markets are generally volatile with an upward sloping trend. Sometimes buying at a low price and other times buying at a high price should give you an effective price of somewhere in between the highs and lows. This should be far better than having a guess at a low. More helpful if you are new to investing. Read about investing through market crash.

Example: Let’s illustrate this by picking a 5 year time horizon within FTSE All Share

The chart shows that if you had invested £6,000 on Sept 2007 (observing amazing past performance of the market), the total amount that you’d get back after 5 years would’ve been £6,247. However, if you had invested £100 monthly over 60 months (100 * 60 =£6,000 i.e. same total amount), you’d then end the period with £7,238!

Please bear in mind that I did indeed cherry pick the time period, taking into account the Global Financial Crisis (GFC) in order to capture large swings in prices. Dollar cost averaging returns better performance when there is strong market volatility (rather than a steady increasing trend which we saw post the GFC).

Another point to note is that Dollar Cost Averaging does not guarantee superior return compared to investing money actively, rather it provides a strategy for decent returns without having to actively study the market (which many individual investors won’t do).

Relevant insight to take away from here is that at the time of writing, April 2020, we are going through extreme volatility in the market – therefore now would be good time to begin dollar cost average investing rather than trying to time the bottom.

The summary

- Equity markets generally follows an upward trend with some volatility

- To benefit from compound interest, keep investment earnings re-invested, do not withdraw the money if you can

- Invest a fixed amount every month without worrying about trying to “buy the dip”

- Dollar Cost Average idea works best during high volatility and market crashes like COVID-19 of 2020