Richest people focus on growing wealth, not really Income : Ever thought why?

Being a high income individual means you are able to lead a comfortable (or luxurious) lifestyle at present. And, being a wealthy individual means you are able to continue the same lifestyle post your retirement. This is why richest people grows their wealth and not income.

There is a huge contrast between earning a higher income and being wealthy. A typical individual would work 40+ years throughout their lifetime to earn a living and save for retirement. As long as we can afford to pay bills and mortgages we seem to remain happy with our income. This feeling of content is actually not helpful. Simply having a great salary is not enough to being wealthy. Here’s 3 key reasons why:

Income growth is lower than wealth growth

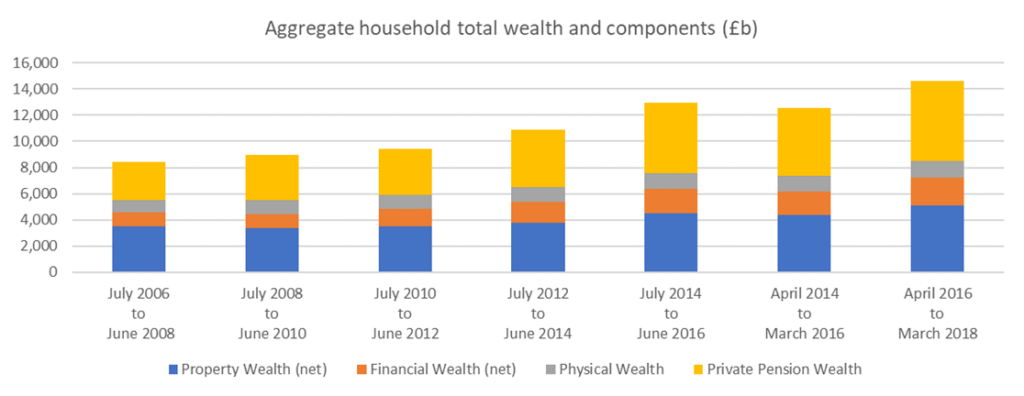

Between 2006-2018, average salary of UK earner has grown by about 28% while richest people grew their wealth by about 74%. The reason behind this gap is key to understanding the importance for converting income to wealth. Lets look at what makes up that wealth and how it looked over time. The big yellow chunk references private pension wealth and it really highlights the importance of investing purely for retirement. This is the reason why high earners, who invests privately for retirement, are able to continue their lifestyle even after retirement. The chart also shows that properties play a key part on building wealth. Between 2016 and 2018, property accounted for about 35% of a household’s wealth. A key asset class for richest people to grow their wealth.

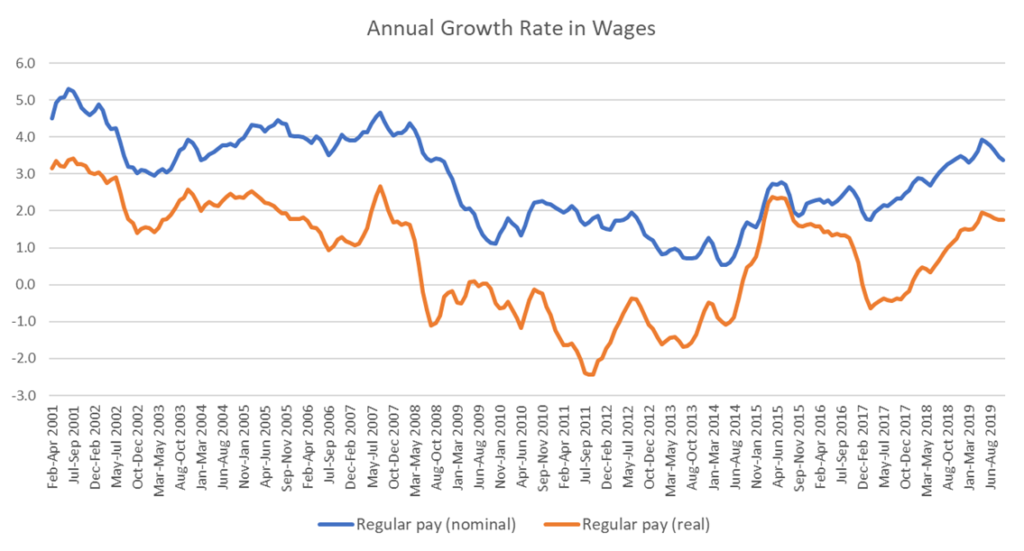

I’ve mentioned growth of just about 28% in cumulative income over 12 years to 2018; but is observing past earnings growth a good indicator of the future? the answer is actually yes! The average annual income growth over last 20 years was only 2.8% in the UK. After adjusting for inflation, the figure reduces to a mere 0.8%. Observing the graph below, you will notice the number is generally sticky with a tight range. What this means for us is that, regardless of how hard we work on our day-to-day job, on average our increase in yearly income is unlikely to grow by a big number (keeping all else equal).

The second point to notice is that, the line gets severely disrupted following a recession (like 2008) and it takes years for the growth to get back to a pre-crisis level. In fact, nominal growth seem to be still on its path to recovery following the Global Financial Crisis (GFC)

income is temporary and expensive, wealth grows better

Salary only comes as long as we can work

Richest people grows their wealth and don’t focus on having a higher income only. Regardless of how good life may feel right now; this is unlikely to continue to our old age unless we take care of our future and build our wealth. Salary is temporary because it is a cashflow that we expect in exchange of our time spent working (for as long as we can). At retirement, this inflow is going to reduce to zero while our expenses are likely to continue. And most likely increase with inflation. This is why it’s so crucial to be able to convert a part of our income into wealth. And then let that wealth grow through the power of compounding. Read my other post on power of compounding to help grow wealth.

Why is earning alot of money Expensive?

Taxes!!! At the time of writing, a high rate earner in the UK would pay a marginal tax rate of 40% on their salaried income. But, richest people who are growing their wealth are paying much lower taxes through corporation, capital gains and dividend income. Did you know: just like personal tax free allowance, governments also gives us a certain amount of allowance on incomes from other sources too? For example, first £1,000 profit from property rental and first £2000 from dividend income is tax-free (at the time of writing). Therefore, you can appreciate making most of these tax allowance is a huge benefit for us to growing wealth. [Find out about your current personal tax free allowance]

Listen to Warren Buffett mention that his secretary pays a much higher tax than he does!

Money at retirement is not guaranteed

A relevant, yet looked over reality is that the money we save towards retirement is not guaranteed for most of us who have a DC pension (Define Contribution) scheme. Defined Contribution pension means that our pension trustees cannot provide guarantee on how much we can get back on our pension at the time of retirement. This makes retiring during periods of recession very difficult. This is because pension investments are generally held in stocks and bonds and their market values can fluctuate down. This brings us back to understanding the importance of why richest people grow their wealth. Having diversified sources of income through growing personal wealth provides a great cushion during vulnerable times. For example, owning properties and a separate private pension pot means we don’t have to only rely on the state or employer’s pension scheme.

So, what should you be actively doing right now in order to take care of your future? A good place to start would be to make sure you are regularly paying towards your pension, especially try to max out any employer matching pension (if you are in the US, it would be your 401k). Secondly, have a go at opening up an ISA (in the UK) to start your personal tax-free investing journey!

The summary

- Having a higher income doesn’t mean you will naturally become wealthy

- Wealth growth is typically higher than income growth

- Tax advantages are multiple across various sources of wealth

- Having diversified level of wealth for pension age is key to a prosperous retirement

- This is why richest people grows their wealth