We need to talk about the racial wealth gap

The racial wealth gap is the term used to describe the vast difference in wealth held by households of different ethnicity. Let’s start with the facts.

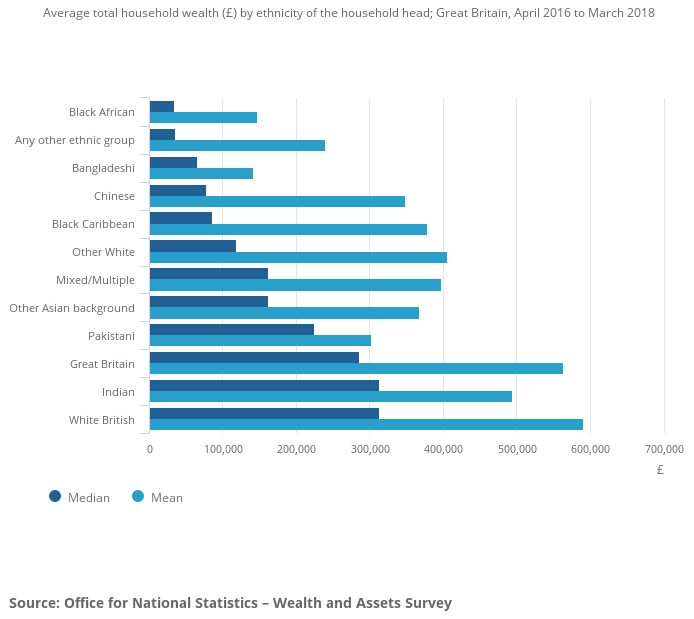

- The median household wealth in the UK ranges from £34,000 among those with a household head from the Black African group to £314,000 for the White British group (latest data from ONS).

- A white British family is 9x as likely to be in the top quintile of total wealth as those of Black African ethnicity and 18x as likely as those of Bangladeshi ethnicity.

- This wealth gap is statistically significant even after adjusting for a range of characteristics (that could also explain the gap).

Why does the gap exist?

Reasons behind why such gap exist is deeply rooted in our history. Money begets money and the passage of time helps it to compound. A family who may have faced discrimination 50 years ago would naturally have less assets to pass on to their next generation. For example, residential homes are one of the most popular assets for generational wealth creation. However, according to the latest data, only 20% of Black African households have home ownership compared to 68% of White British household (Source: ONS).

In addition to structural gaps in generational wealth, accumulation of one’s own wealth comes from: (a) Creation of wealth through increasing income; and then (b) Preservation of wealth through investing in a “growth” asset. As such I can think of 3 major reasons behind why the wealth gap still remain.

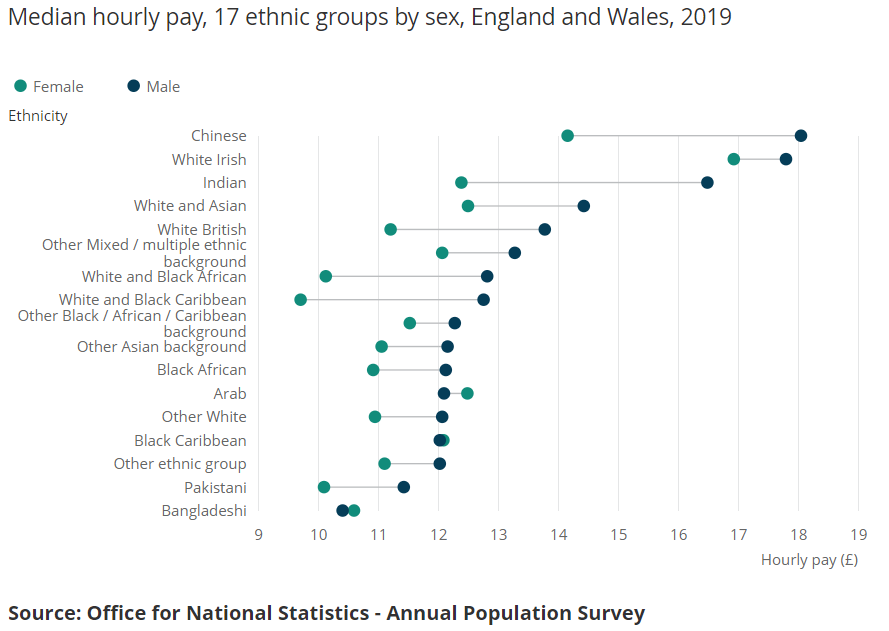

Pay Gap

Most ethnic minority groups earn less on average than the white British group, some significantly less than the others. For example, the median group of Pakistani, Bangladeshi, and Black African people earns circa 15% less than the median White British group.

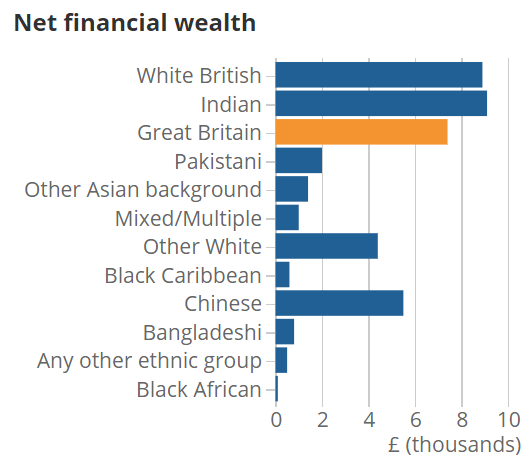

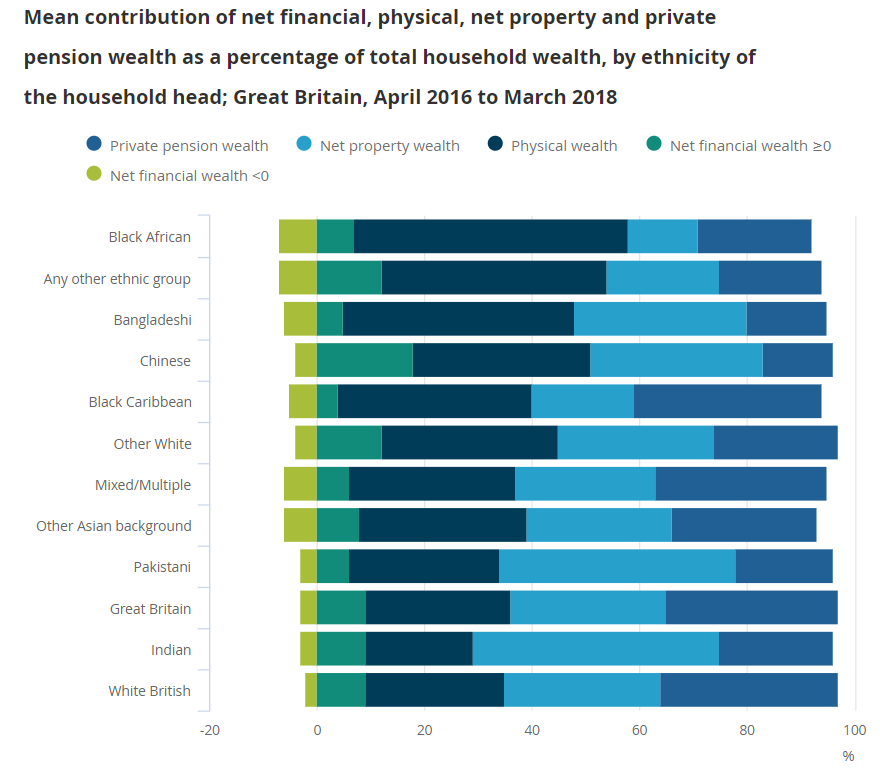

Investing Gap

A key source of household wealth comes from financial assets such as investing money in stocks and shares. White British and Indian households have the highest allocation to this form of wealth. ONS calls this “Net financial wealth” (financial assets minus liabilities such as loans/credit cards). Black African families are approximately twice as likely to have negative net financial wealth as those from the White British group. In simple terms, some households have high level of debt and exceptionally low level of investments. A high level of debt usually slows down any progress of wealth creation.

Financial Literacy gap

Financial literacy starts at school. The Education Policy Institute (EPI) has published the attainment gap between disadvantaged pupils and their peers. A disadvantage pupil is someone who comes from a low-income family or has less family support. Disadvantaged pupils in England are 18.1 months of learning behind their peers by the time they finish their GCSEs – the same gap as five years ago. The troubling fact is that some ethnic groups have experienced growing inequalities over recent years. For example, Black Caribbean pupils were 6.5 months behind White British pupils in 2011, but this gap has now regressed to 10.9 months.

What can we do about it?

Learning and sharing

Constantly learning about the current situation and checking progress is key. It is unrealistic to expect any change overnight, however if we start with ourselves, we can make progress one step at a time. This starts at home:

- take stock of the school’s approach that someone you know attends,

- challenge to have high quality teaching, and

- promptly address any behaviour or attendance issues. Engaging young people to seek mentorship and joining organisation that helps with getting work experiences can also help.

Same goes with improving one’s own financial literacy gap. Especially due to COVID, many personal finances have taken a hit, and so it has become more important than ever that we and our families understand basic financial concept such as interest rate, inflation, and time value of money.

Investing money

A lot of people, especially from the BAME households are unaware and as such afraid of investing money in stocks and shares. While investing does come with risk, over the long-term it provides an exclusive opportunity to grow our money by the power of compounding. In the UK, we are lucky to have an allowance of £20,000 every financial year to invest tax-free through an ISA (Individual Savings Account). It may also be a good reminder to ourselves that even if we don’t invest money directly, those of us with pensions are automatically exposed to the stock market. This is because our pension contributions are generally invested in stocks and bonds which allows the pension pot to grow by the time we retire. Talking about these important concepts over a casual chat may well be all it takes for someone to get interested in investing.

Focus on career development and encourage others to do the same

We should try to stay informed on typical income levels that are assigned to different jobs and encourage other family members to also do the same. Unlike gender pay gap, release of ethnicity pay gap report by companies is not yet mandatory. However, some companies do volunteer to release this information. Having said that, I am aware that there are times when one may face obstacles getting through to a high paying job due to competition and not knowing the “right” people. In that case working with a recruitment agency that focusses on diversity and other organisations that facilitates BAME recruitment may help.

...final thoughts

As you have have guessed, this topic is extremely close to my heart, and I believe it’s time we make this real personal!

Other links in my post may also include affiliate links from Amazon. I may earn a small commission (at no extra cost to you) if you purchase a product using these links.