Stocks vs Bonds | How bonds work

How bonds work is an important concept to understand because it is very different to stock investing. There are more literature out there on stocks than bonds. Bond investing has more intricacies and variations compared to stocks. This makes direct bond investing much harder and less accessible to small retail investors. However, bonds provide stable income options with less risk compared to stocks. Therefore, it’s about time we understand how bonds work!

What is the difference between stocks and bonds?

Investing in stocks gives the ‘investor’ ownership of a company. Investing in bonds makes the ‘investor’ a lender to a company or a government.

Bonds can be corporate or government. Buying a corporate bond means lending the investment to a company in return of an agreed coupon (income) over the course of a given time frame (maturity). The investor also receives the original value of the bond (face value) at the end of its maturity. A similar principle applies to government bonds as well. UK govt bonds are known as gilts and US govt bonds are known as treasuries. With government bonds, instead of lending money to corporations, money is lent to the government of a country.

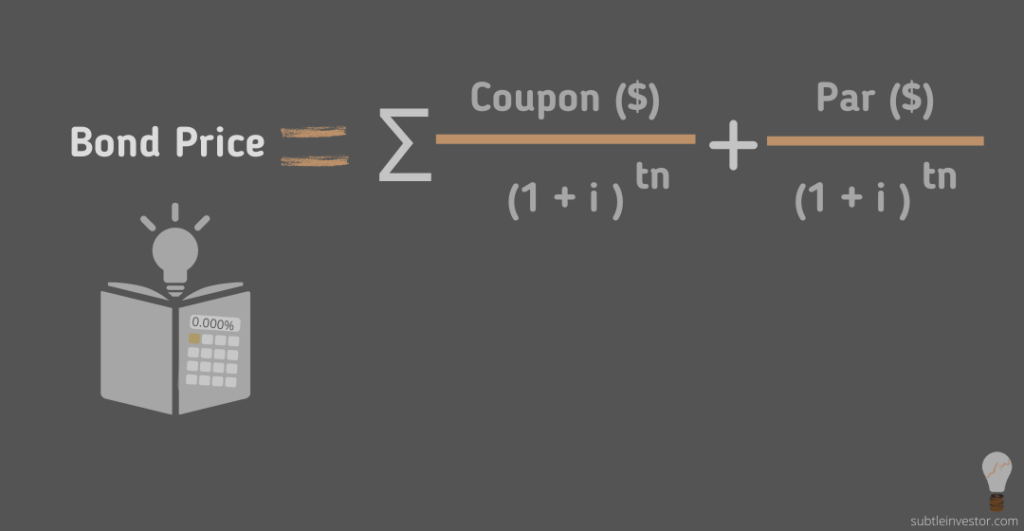

HOW BONDS WORK – BOND PRICE FORMULA

A simple bond can be priced using 5 main factors:

- [i] interest rate. This is the current market rate or required yield used as the discount rate in calculating the price of a bond

- [Coupon ($)] These are scheduled income ($ amount the investor receives at an agreed frequency) i.e. $100 per year

- [t] maturity. This is the length of time the bond is expected to exist i.e. 10 years

- [n] It is the frequency of coupon payments i.e. semi-annual

- [Par] also known as face-value, is the true underlying value of the bond. This amount is expected to be returned to the investor if the bond is held to maturity i.e. $1,000

Put simply, price of a bond is the present value of all its future coupon payments plus the face value/par value

Bond price formula highlights existence of a negative relationship between interest rate and price of a bond. When interest rate is low, bond price is high and vice-versa.

Advantages of bond investment

Income stability: unlike stocks, bonds work by stating its expected coupon (similar to stock dividends) at the time of investment. This feature reduces any uncertainty around future income.

Known total return: investors can calculate expected total return of a bond investment before making a purchase. A bond’s total return is known as “Yield to Maturity” (YTM). At the point of purchase, market price of a bond, it’s coupon and maturities are known. Applying the formula above to rearrange and solve for ‘i’ (interest rate) we can calculate the yield-to-maturity!

Safer than stocks: Since a bond investor is a lender and not an owner of the company, when a company goes bust, the bondholders are first to get their money back.

Less volatile: bonds work with less volatility compared to stocks. Since shareholders have lower pecking order when it comes to payment at default, stock prices react more aggressively to negative news

Principle money is fully returned: Bond investors are effectively providing loans to a company or a government; as a result they are expected to get the principle amount back at maturity. This amount (known as par value) is the underlying true value of the bond.

disadvantages of bond investment

Limited upside: bonds work by formulating expected return upfront. And so, bond investors are limited to that outcome. The best case scenario for a bond investor is to receive their money back at the end of maturity. In contrast, a stock can potentially give unlimited upside because stock prices can continue to climb up.

No voting rights: because bondholders are not owners of a company; they do not get any voting rights in the company’s business. Bondholders cannot influence company decisions on important topics like: how the company profit should be distributed. This right is instead enjoyed by the shareholders

Companies may default: although bonds are generally safer than stocks, some companies can still default on its payments. Therefore, company level risk is something no investor can get away from.

“Bond investors are the vampires of the investment world. They love decay, recession — anything that leads to low inflation and the protection of the real value of their loans” – Bill Gross

Key risks with bonds

Duration: Bond duration highlights sensitivity of a bond price to the interest rate. It is measured in years and takes into account time left to maturity and coupon rates. Duration tells us that an one-year bond is less sensitive (safer) to interest rate compared to a 30-year bond. (Note: if coupon is 0, then duration is equal to years left to maturity). Due to negative correlation between interest rate and bond prices, higher the duration of a bond, higher is its risk. For example, a bond with 5-year duration is expected to go down by 5% if interest rate rises by 1%. Therefore, selling bond investments at a time when rates are going up can result in a loss.

Ratings: One of the ways of understanding bond risk is by looking at its rating. These ratings are provided by agencies such as Moody’s and Fitch. High rated bonds such as AAA is less risky compared to a junk bond with a C rating. As ratings in bonds can change, they can also impact prices and investment value.

Default risk: this is when a company can no longer make its scheduled payments, such as expected coupons to the bondholders.

Inflation: when inflation is high and rising compared to interest payments, they can eat away an investor’s real rate of return. (You can read my previous post on how inflation impacts real rate of return.)

Is bond investment right for you?

Just like any type of investments, bond investments also come with its share of risk. However, there are plenty of good reasons for holding bonds in an investment portfolio.

Bonds provide diversification benefit. Stocks and bonds tend to perform differently across various economic climate. Bonds generally outperform stocks as the economy starts to slow down following a peak. [Here is a link to my recent post on interest rate and the economic cycle]

Price volatility is typically less in bonds compared to stocks. Therefore, bond investments help dampen any negative performance during a volatile market period. Including them in a portfolio can reduce performance volatility compared to having a 100% stock only portfolio

Bonds work by providing a stable source of income. This is particularly helpful if the investor requires a certain level of inflow over a period of time. In technical terms, this is known as cash-flow matching.

As a rule of thumb, percentage of bond investment in an investment portfolio should be increasing with one’s age. One school of thought says, % invested in bonds should be equal to the investor’s age. For example, for a 50 year old investor, at least 50% of their portfolio should be held in bonds. In contrary, a young investor wishing to grow their wealth over time, should allocate a higher percentage in stocks.

The summary

- Bonds generally outperform stocks when the economy is slowing. Therefore having some bonds in an investment portfolio can provide diversification benefit over the course of a business cycle

- Investment in coupon paying bonds provide a stable source of income compared to stocks

- Direct investment in bonds are not easily accessible for small retail investors. Therefore, the best way to get bond exposure is through an ETF or a mutual fund

- Expected total return from a bond can be calculate prior to its investment (unlike stocks)

- Bonds do not provide unlimited upside and comes with its own share of risks (duration and defaults)

- It could be beneficial for every investment portfolios to have some exposure to bonds. These exposures should also be increasing with the investor’s age