IS NOW A GOOD TIME TO BUY A HOUSE?

House prices have fallen for the first time in 8 years! Property investment have remained one of the most popular sources of passive income and route to wealth creation. Residential properties not only provides us with a place to live in; it equally works as an investment. Therefore, taking out a mortgage is one of those guilt-free sources of debt.

Benefit of buying a house = passive income (through rents) + capital appreciation (increase in property prices)

House prices in the UK, especially in London have been on the rise for a long time. Getting onto the property ladder has been a challenge for the many. However, the UK government has introduced quite a few policies to help first time buyers. The most recent being slashing stamp duty until March 2021. Keep on reading to learn about current property prices, costs and relevant policies that makes right now a good time to buy a house. Looking back at this in years to come – I think we will call this once in a lifetime opportunity!

Current market prices – is now a good time to buy a house?

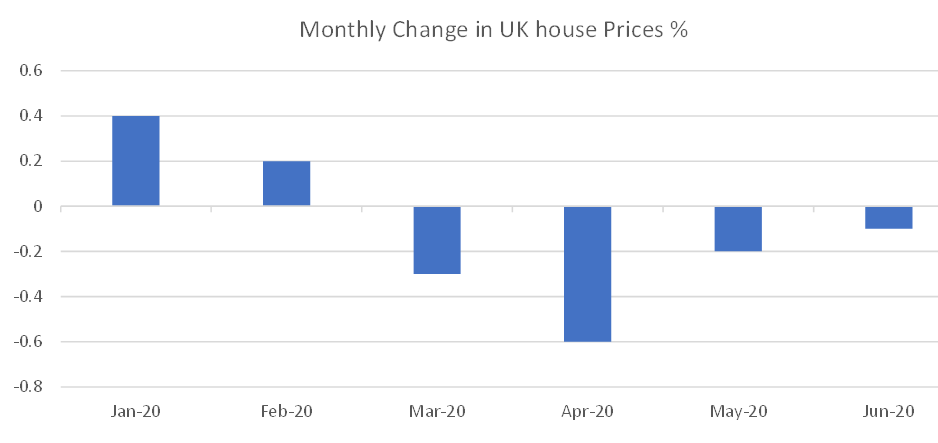

House prices in the UK have fallen for consecutive 4 months in a row (to June 2020). This decline in price is not unexpected given the economic impact of coronavirus. If the trend continues, it provides a great entry point for buyers to step onto the property ladder.

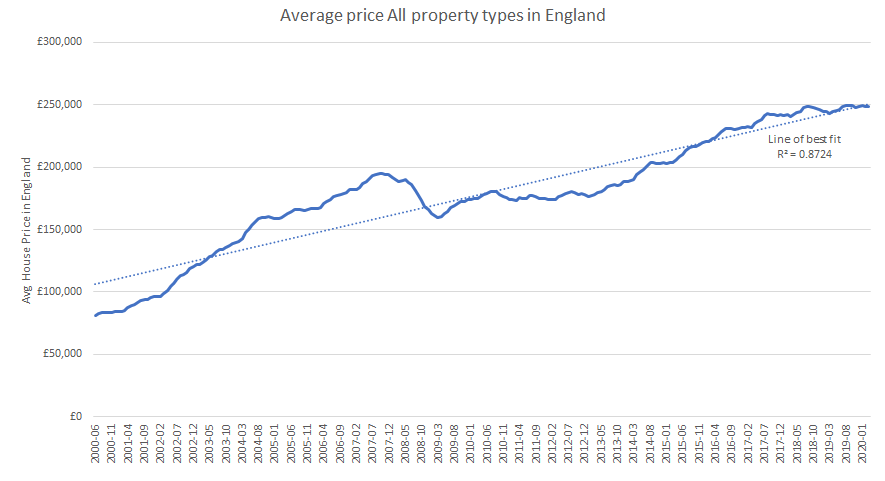

Like the stock market, one of the key advantages of buying a house is that over the long-run the value of it rises. A fundamental reason behind this is that supply of land is limited while demand for properties are constantly increasing (for reasons such as population growth, economic expansion etc). The chart below shows property prices in England. Notice the long-term positive trend highlighted by line of best fit. Currently house prices are trending below the line of best fit.

Benefit one: Zero stamp duty until March 2021

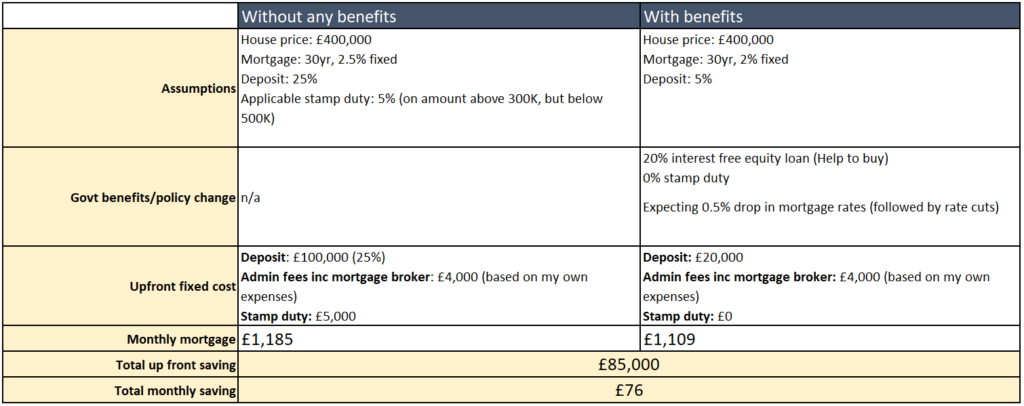

Stamp duties are one of those high upfront costs that deters many people from buying a house. It is a percentage amount on the value of the property that is paid to the government as tax. Due to worries fuelled by the pandemic, the government has introduced a short-term measure to scrap this tax for properties below £500,000, up until March 2021. Just to put this into context, someone buying their first property worth £400k prior to the pandemic, had to pay £5,000 which now comes down to £0.

Please note, for people looking to buy a second property or buy to let, the original 3% levy on reduced tax bracket still applies. However, even with that it is really a bargain!

Check out government’s calculator to understand how much exactly you may need to save for this tax.

0% STAMP DUTY

£££ SAVINGS UNTIL MARCH 2021

Benefit two: zero interest rates (nearly)

Another key costs with mortgages are interest rates. Again, due to the pandemic central banks around the world are cutting rates (some are even expecting negatives rates!). Interest rates have been coming down over the years. Monetary policy committee will look to start increasing them again once the economy starts to recover from the pandemic. In order to better understand the history and what it means for rates to come down or become negative, please check out my other recent post here. Most recently, at the time of writing, the market is expecting Bank of England to cut rates further to 0% in their MPC meeting in November

Securing a mortgage with lower interest rates can significantly reduce monthly payments that is made to the bank. Just as an example, a 25 year mortgage of £300,000 with current interest rate of 2.5% could save nearly £150 per month if rates decrease by 1%! Here is a simple formula that banks use to determine monthly mortgage payments.

Monthly mortgage cost = Interest cost + repayment cost

The repayment cost is simply the total amount mortgaged divided by the mortgage time (i.e. 300 if it’s a 25 year mortgage). Interest cost could be thought of as the price paid to the bank for borrowing money from them. Generally, interest costs are extremely high during first few years of the mortgage term. This is because it is paid on the amount of money remaining in mortgage. With passage of time the amount remaining decreases as we pay back the original amount borrowed through “repayment”, hence reducing interest costs.

Benefit three: Higher Loan-to-value mortgages

Loan to value (LTV) is the mortgage amount borrowed as a percentage of the property price. Typically, banks prefers to lend when LTV is 75% or below. However, some banks, such as nationwide have announced that in order to help first time buyers they will provide up to 90% LTV. This is particularly helpful for individuals who were not able to save enough but are financially sound to keep up with their mortgage payments. In other words, this means individuals can buy a property with only 10% deposit. For example, for a property worth £200,000, a £20k is all that is required compared to what is typically expected (i.e. £50k with 75% LTV). This highlights that not only the government, but the market players are also on the side of new buyers, making it a good time to buy a house.

Benefit four: Government's Help-to-buy equity loan

Let’s not forget that government’s help to buy option is live as well. Government has extended this scheme for new buyers from 2021 to 2023. Help to Buy can help first time buyers with reduced mortgage payments as the government lends an interest free equity loan (for first 5 years) as much as 40% of the property value in London (and 20% elsewhere). Having this reduces a huge chunk of the cost and makes it a good time to buy a house. Take a visit to the dedicated website to learn more about it.

The summary

- Now is a good time to buy a house (for living or as an investment)

- The government is introducing and maintain policies for making home ownership easier

- Monetary policy is now accommodative as rates the continuing to drop and this can significantly reduce monthly mortgage cost

- House prices are trending down over the short term fuelled by the fear of pandemic. However, over the long-term house prices always go up

- Properties are great (potential) investment as they offer passive income through rents and wealth growth through long term capital appreciation