How Pension funds work: A to Z for beginners - AND why you need to ACT NOW while still young

What is a pension fund?

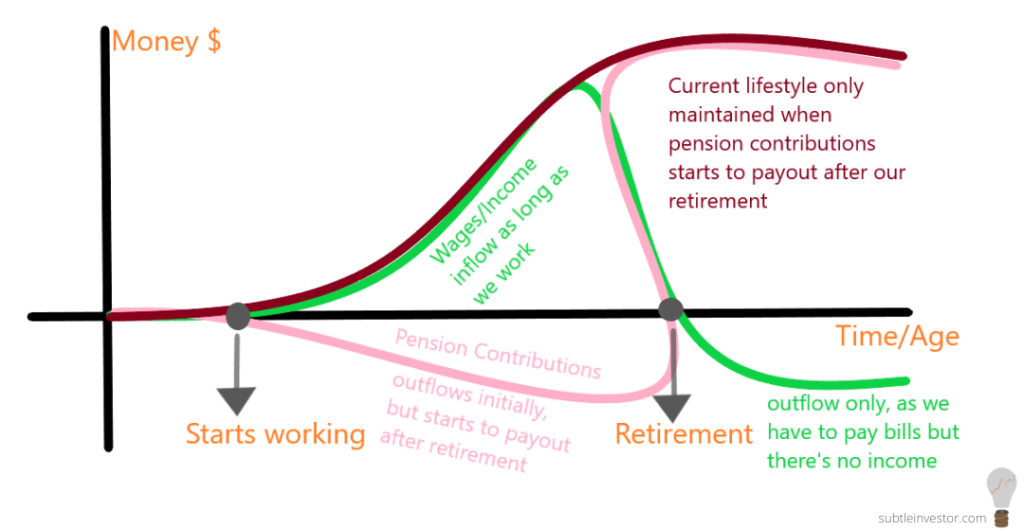

A pot of money invested throughout one’s working life to financially support their retirement. It comes from the Latin word Pensio, meaning “payment”. Every month a working age person would put some money away in a “pension pot”. And this pot cannot be touched until they reach retirement age. Over time between now and retirement, the pot is expected to grow through investments in stocks and bonds. When the person retires they can use that money to pay for their living expenses until they decease. Chart below highlights movement of money over our lifetime and why investing in a pension fund is so crucial.

Public (State) vs Private pension and how much pension can you expect to get?

State: If you work in the UK and make National Insurance contributions for min 10 years, you are eligible to state pension. If you meet the state’s criteria, you should be guaranteed to get the full basic state pension. The amount currently stands at £175.20 per week. This responsibility lies with the government and you (the employee) hold no risk or worry. [Check out official up to date guidance]

Private: most private employers offer private pension schemes, as perks, to all their employees. This is in addition to the state pension. The employees can also make voluntary contributions to that private pension fund as they seem fit. Although voluntary, it is highly recommended and extremely important that you build up your own private pension fund. This will ensure you do not completely rely on the state pensions. [Read my post on importance to private pension]

Unlike state pensions, employers can choose what type of pension pot to offer their employees: Defined Contribution (DC ) or Defined Benefit (DB).

DB pensions are very generous because it is paid on a rule- based formula (such as your average wage & years worked at the company). The formula determines how much you can expect to receive at retirement regardless of how your pension fund performs. Therefore, the risk & responsibility for DB pension lies with the employers (just like the governments with their state pension).

In contrast, DC pension risk & responsibility completely lies with the employee (i.e. you). This is based on how much you have contributed and how well your investment pot has grown. This is why it is so important to understand and take control of where your pension money is invested.

Over last few years there has been a strong shift from DB to DC schemes. This is because employers realised that it was posing a greater risk on their own balance sheet and profitability.

How pension funds work

As the responsibility of state pension fund lies with the state, there is nothing for the employees to actively do in increasing its end value. The current new state pension is £175.2 per week. This is expected to grow annually by higher of the following three growth values:

- Earnings – the average percentage growth in wages (in Great Britain)

- prices – the percentage growth in prices in the UK as measured by the Consumer Prices Index (CPI)

- 2.5%

How private pension funds works is more interesting. Employees have total control of how to form their pension fund and how much to pay towards it. This can be done through employer’s pension scheme or directly through a SIPP, Self-Invested-Personal-Pension. SIPP is primarily used by people who work for themselves. However, it is also open to everyone, regardless of whether they are working for a company or not. Pension fund works by investing the of your pension pot in various investment products. This includes funds made up of stocks, bonds and cash. These investment products are expected to grow over time, potentially increasing more than inflation. This makes sure that by the time you retire, you have enough money in your pension pot to live off it. Continue to read below example of how Little Miss Savvy is taking control of her pension fund!

Example: meet Little Miss Savvy and see how pension funds work for her

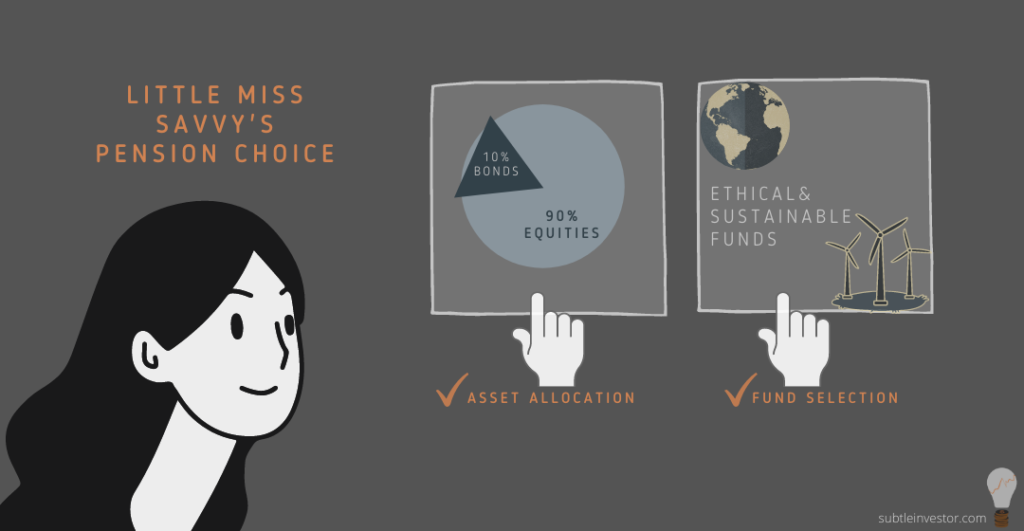

Little Miss Savvy invests 10% of her pre-tax salary on her pension fund. Her employer also adds another 10%. Therefore, each month she is adding 20% of her income towards pension. When working for her employer, she noticed that her pension fund was automatically investing in a 60/40 investment plan. 60% invested in stocks and 40% in bonds. Since she was young and able to take more investment risk for higher future growth, she decided to change the asset allocation to 90/10. She also did not like where her equity investments were going. As a result, she also changed her choice of equity investment from an ordinary fund to an ethical fund. After making all the changes, every year she receives an updated report on how her pension fund is doing. The report also projects how much money she can expect after retiring.

Projected pension pot is estimated using information such as expected rate of return on the pension funds (i.e. say 6% return per year), years left to retiring and how much contribution is made (i.e. 20% every month). There are also other factors at play that actuaries estimate in coming up with a realistic value such as increase in wage growth, inflation and interest rates.

Over the years Little Miss Savvy’s pension pot would be growing and getting bigger as her investments do well. By the time she reaches her retirement age, her pension pot should be getting closer to an amount from which she can comfortably live off it without having to work. And this is the simple mechanics behind how pensions work.

How to make sure the pension fund works best for you

It is prudent to start by learning what your employer is offering you. Some companies are generous and do pension match, where they match an employee’s pension as a % up to a certain amount. Here are three hypothetical scenarios:

Therefore, make sure your pension funds work best for you by trying to max out on your employer’s matching contribution (if possible)

You can also make the most of it by choosing where you want your money to be invested. Recall Little Miss Savvy: she chose to move her money from a 60/40 strategy which was low risk/low return to something high risk/high return because she was young and was able to take on more risk. The opposite holds true as well.

7 reasons why you should pay into a private pension, starting NOW

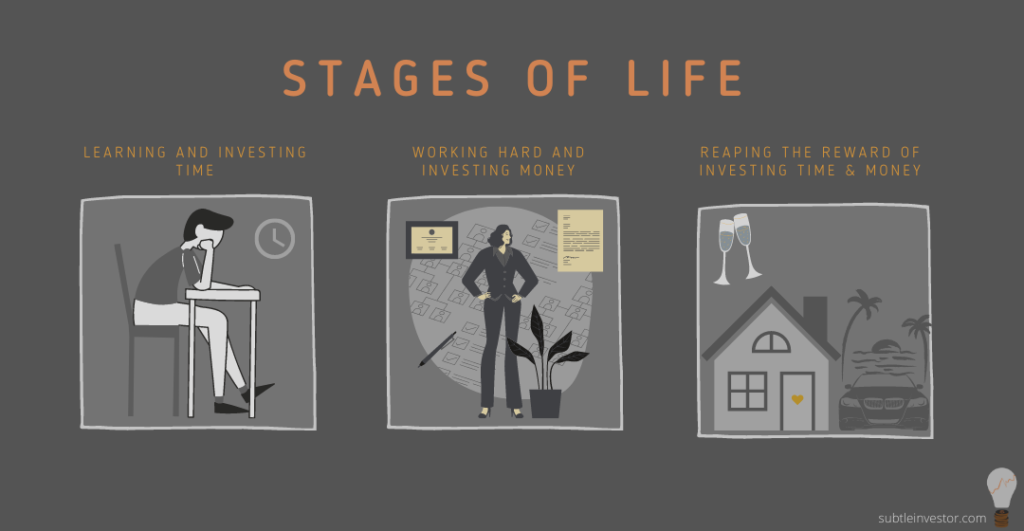

- Sooner you start, more time you will give your pension fund to work and accumulate money. Pension fund works best by letting it grow through the power of compounding [have a read about this very important concept called the power of compounding here]

- Saving privately through an employer allows you to invest from pre-tax income, reducing your taxable income and pay less tax

- State pension is very minimal and limited. It would be exceedingly difficult to solely rely on it for future. Can you continue your current lifestyle on £175 per week?

- Private investing means you have greater control on how your pension fund works. Allow your investments to reflect your values and risk appetite

- Get matched employer contribution (if any) – this is essentially free money so better to max out on this option

- As long as you live, you will need money to carry on leading a decent life, whether it is to pay bills or go for a holiday. Bills and expenses will carry on increasing with inflation. Therefore it makes sense to invest now and allow your money to grow and keep up with rising inflation (at bare minimum). [have a read about how inflation eats away your cash if left un-invested]

- You can always take out a maximum of 25% of your pension pot as a tax free lump-sum from the age 55! So, it is a great investment either way.

What happens when you retire

When retirement age approaches, you will have quite a few options with what you can do with your pension pot, such as:

- Take all of it as cash (25% will be tax free and rest will be taxed at your highest tax rate) – not a great option as you are likely to land a very high tax bill but it is still an option for you

- Convert all of it or part of it to a lifetime annuity for a guaranteed taxable income per month/year (just like a job, except you will not be working). Annuity is an investment product you buy from a company, who will take your money and in return offer you a regular cash amount every month/year until you die

- Reinvest all of it or part of it (remember first 25% cash withdrawal is tax free) into another fund to provide with ongoing income (and of course some capital growth) – however just like any investment this wouldn’t be guaranteed income and will be met with volatility of the market

- Leave it untouched until you feel you need it so that it can grow even more. This is also a good option if your retiring age coincides with a recession shrinking your pension pot (in that situation you can wait until the market and your pension pot tops up again)

Summary: Actions to take right now

- Start contributing to a private pension if you have not already started. This means either through an employer or SIPP. If you are late to start saving for a pension, say from the age of 40, then be aggressive with the amount you are saving. i.e. at least start with 20%

- As a company employee, check out what sort of matching pension contribution they are offering, and try to max out on that if possible

- If you are already contributing towards a pension, it is worth understanding where your money is being invested. Learn about investing and reallocate to where you feel more comfortable