How to invest when market is high

Sure, it feels scary to look down from market highs, especially if you consider yourself a cautious investor. It takes courage to hit “buy” when the market is at all-time high. There are plenty of thought pieces out there pointing to investing during market crashes but truly little on how to invest when market is high. So, I wanted to have a go at this. By the time you finish reading this post, I hope you will feel much more comfortable investing during the market highs.

Though it may sound strange to hear, “continue to buy and remain invested even when market is high” – I do stick to this view. We have engineered our minds to think “buy low and sell high”. The phrase is catchy and sounds good in principle, but the reason why this phrase is so popular is because of our flawed psyche. What do I mean? I mean we “feel” and hence “act” differently to winning versus losing. A renowned psychologist Daniel Kahneman have found that, we feel twice as much hurt as happy when we lose £100 compared to winning £100. Our thought process is skewed. And so, we need constant reminders to think rationally and prevent panic sells when the market is down.

But in this post, I am not going to sell you fears and mention about market corrections like many of the online contents I (unfortunately) happen to come across these days. Because, you know what?

Okay, I did not say that, but Peter Lynch did. He is one the most successful investor and a stock picker of our times. In plain language this quote tells us: don’t try to time the bottom. However, my aim is not to fill this post with euphoric thoughts on investing, but I really want to back my assertion on staying investing with some real-world data. Before, I dig into the data, here are 3 important tips and strategies to follow on how to invest when market is high.

1. Think long term

Genuinely think about what can really happen to the stock market from this moment onwards. Even if you think over next 6 months, there are only 2 real possibilities of where the stock market can go. It can either keep going up and return positive or it can drop and have a negative number. We do not know the future. And given how random the market is, we should rationally give a 50/50 probability of a up and a down market over the short term. Therefore, in 6-month time you should either feel one of these two things: “I wish I bought more 6 months ago”, or “great I can now buy even more” as prices are now lower.

And now, I would like for you to extend your thinking a little far into the future and think about the next 5-10 years. Realise the fact that there is a “trend” line on stock market performance. The trend line is more likely to be positive than negative. Yes, it can be volatile around the trend line, offering tactical buying opportunities. However over long term, this line will be upward sloping. This is because the stock market reflects our underlying economy’s health. As long as the economy keeps growing, which it is expected to (otherwise we would go back to the old age of trading chickens)– so will this line. Stock market index reflects the country we live in and so over the long term we will be OK! Therefore, don’t look back or don’t look down, just look forward.

Caveat this is not to say, put all your money in it right now. Just be cautious and stick to you plan.

2. Have a plan & stick to it

First part of an investment plan would be to have a strategy you can follow. Give yourself a “normal market” strategy and a “bear market” strategy. A normal market strategy could include a plan to invest 15% of your monthly salary every month. You can set this to auto-invest with the criteria to reinvest the dividends. For “bear market” strategy, you can apply Dollar Cost Average or an early exit plan. Dollar Cost Average is a great way to invest during volatile market or when the market is dipping. As long as you still have good level of conviction in your investment, you can choose bear market opportunity to buy some more unit at a bargain price. This will effectively reduce the total cost per unit of your investment. If on the other hand, there is a huge shock to a certain part of your investment and it no longer meets your suitability, then apply an exit strategy. It is important to have an exit plan to prevent panic decision making.

Second part of an investment plan is to design a well-diversified portfolio. We call this Portfolio Construction. An extreme example of having zero diversification would be to hold all your investments in a single stock. If you personally design your stock investment portfolio then consider having a minimum of 15 stocks to get some level of diversification. If you only invest in funds, diversification can be added by including investments across different geographies, sectors, style and market capitalisation. In practice:

- Bond funds adds diversification to equity only funds

- Emerging market index adds diversification to developed market portfolio,

- Small cap stocks can help diversify large cap stocks

- Value investing style diversifies growth only stock portfolio, etc

3. Avoid herd mentality

We live in an interesting world. Unfortunately, many of us are fed with non-stop news from so called “money gurus” whose ultimate aim is to either spread fear of doomsday or spread false euphoria around getting rich quick. It is not easy, but we should always try to control our mind to cut through the noise and re-focus. We should aim to think rationally. So, why herd mentally is so dangerous? To understand it think of what happened to London’s Millennium Bridge! London’s Millennium bridge opened on 10th June 2000. Just like any new construction project, a lot of work and test was carried on it before it was safely open to public use. However, on the day it opened, when it was crossed by 90k people, it had an unexpected vibration and began to wobble! For safety reasons, it had to close. After much research & studies on the bridge, the engineers found that the reason why the bridge was wobbly was not due to the number of people or their weight, but the fact that all these people were moving in a synchronised manner, triggering a “positive feedback” cycle.

Funnily, we can apply this to the stock market. Herd mentally is like a “synchronized movement”, which can put a strange & unnatural pressure on the stock market forcing it to break. The stock market price is expected to reflect underlying intrinsic value of the companies and not what people think it should be. And so, when everyone thinks “buy buy buy”, it keeps pushing the price up. Sometimes, far up to a point that it forms a “bubble” ready to burst. On the flip side, when everyone thinks “sell sell sell”, again it puts undue pressure on the line, causing it to crash. Therefore, between these two-real option – do you want to be in this wobbly bridge full of synchronised people? Or would you rather think rationally and take your own path?

...Is buying at “all time high” even that bad, after all?

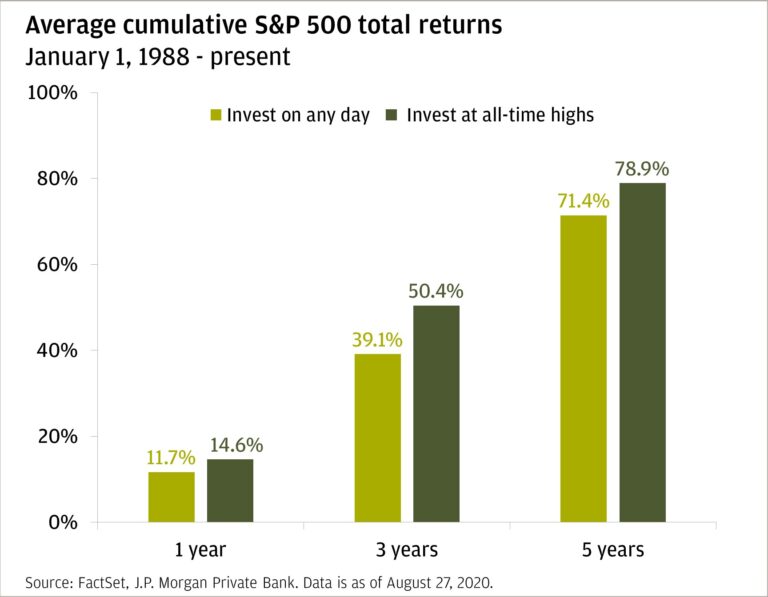

Not really. At times it is even better actually! Look at the chart below from JP Morgan. They found that from 1988 to 2020, if you invested in S&P 500 on any random day, your investment would have returned positive performance over 1 year 83% of the times. On average, returning you +11.7%

But, if you only invested when S&P 500 closed at all time high, you would have gotten positive return 88% of the times with average of +14.6%

(Yes you read that right)

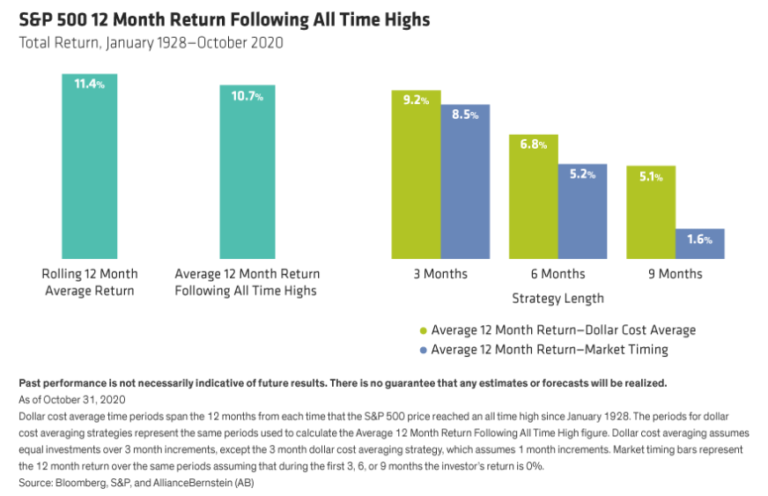

There is another great study from Alliance Bernstein which highlights how to invest when the market is high. They went back even far and started from 1928. They found that investors earned an average +11.4% return over any given rolling 12-month period, regardless of what the market was doing. And if the investing time was not random, and only during all time highs, it still returned +10.7% (which isn’t so bad, is it?)

But the thing that truly caught my eyes was the part of the return analysis on investors who were too cautious. They found that if a cautious investor waited to time the market by not investing for 3 months, they would’ve got 8.5% (3% less than ‘random’ day return). And, if they waited 9 months to invest, they would’ve gotten an average of 1.6%. Both 8.5% and 1.6% is below 10.7%.

How incredible is this!?

The summary

- A genuine reminder to myself: no need to time the market. It simply doesn’t work

- It is better to remain invested than not

- It is important to think long term because the stock market usually trends upwards over time

- Have an investment plan and stick to it (both for normal market and bear market conditions)

- Have a good level of diversification in portfolio

- Avoid herd mentality and take time to think rationally (again having a plan would help!)